If you're on Twitter, watch the news on TV or YouTube, or listen to it on the radio, you've probably heard a lot of noise about the economy. And if you're anything like me, you might have a million questions bustling around in your head like:

- Is the economy headed for a recession!?

- Is this just normal noise and nothing really to freak out about?

- Or is the sky actually falling!?

- Is this all just a political stunt in preparation for the midterm elections?

Sometimes it is just noise, we're just hearing about it now more than ever thanks to social media. But sometimes, maybe, there's some truth to the narrative.

I want to help provide some non-professional context to some of the noise that I've heard recently, both for your sake and mine! Below is a list containing snippets of content and media from various talking heads about the state of the U.S. economy, both macro-perspectives and micro.

Bookmark this list as I'll look to make regular updates going forward.

If you are an expert, we'd love to hear your thoughts in the comments below. Perhaps you can correct something that I've misstated. If you're not an expert and found or heard some news that was troubling to you, sign up for free and add those in the comments below!

November 8, 2022

Between 1959 and 1990, individuals could sustain their inflation-adjusted standard of living with only #incomes and #savings. Since 2008, it requires an increasing level of debt to “fill the gap” to afford and the cost of the current living standard. https://t.co/5vlvNPcJZy pic.twitter.com/UkvtsnMeUQ

— Lance Roberts (@LanceRoberts) November 8, 2022

In this series of tweets, Lance Roberts gives special emphasis to the extreme rises in the cost of living for families in the United States.

To summarize the tweet and further context provided by the article, until 1990, families could sustain their standard-of-living by leveraging only their income and savings. Actually, the average family could sustain their standard-of-living and still have a $4,700 surplus at the end of year.

However, in 1990 and accelerating during the 2008 Financial Crisis, income and savings wasn't enough to pay the bills anymore. That's when consumers started relying more on credit to help "fill the gap" than ever before.

And that has only accelerated the past few years. On the chart, you can see an even greater reliance on credit in the past few years.

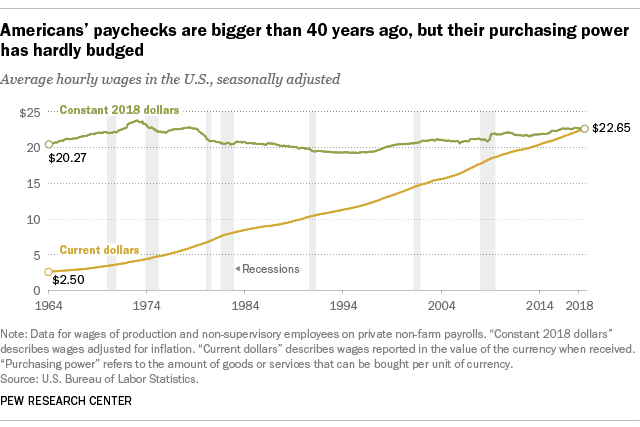

There are 2 basic factors at play here, the first being our income. Our income simply doesn't go as far as it used to. This chart is from 2018, but it shows that, while the hourly wages of employees have gone up since the 1960s, purchasing power has remained about the same.

Unfortunately, although our purchasing power hasn't increased, the goods and services that we purchase have by about 830% at the start of 2022

The second factor at play is our standard-of-living, and this is perhaps what we could address first if we're looking to make smart financial decisions for the futures of our families.

Whether or not we think this is fair, or we'd rather point our fingers at politicians or the 1%, we want to commit to making wise decisions, digging ourselves out of financial holes and live debt-free lives. The first step toward making that a reality is by lowering our standards-of-living, at least for a time.

What luxuries can we do without, if removing them would allow us to avoid credit card debt? Can we replace expensive hobbies with cheaper, just as meaningful ones?

It might not be what we want to hear, but coming to grips with the reality that our society finds itself in may help us to better prepare and respond before it's too late.

If you'd like to keep up with the economy and personal finance, and prepare for an U.S. economic downturn, sign up and you'll get a free email newsletter in a format like this sent to your inbox every Thursday morning!

November 7, 2022

About 49% of restaurants were unable to pay their rent in October, up from 36% in September, per Bloomberg.

— unusual_whales (@unusual_whales) November 7, 2022

37% of real estate agents couldn’t pay their rent in October, up from 27% in September, per Bloomberg.

— unusual_whales (@unusual_whales) November 7, 2022

Like we analyzed from Sven Henrich's tweet on November 1 focusing on small businesses in general, now we're seeing data that a large percentage (half) of restaurants and over a third of real estate agents couldn't pay their rents in full during the month of October as well.

It's no doubt that restaurants struggled during the pandemic, and we can understand why real estate businesses may be struggling right now with the recent rate increases stalling the housing market.

As U.S. citizens, this is worth monitoring, because businesses can float debts for only so long before they need to close which means employee layoffs.

November 6, 2022

Retail is flocking into puts like never before.

— Game of Trades (@GameofTrades_) November 6, 2022

Remember how many times retail is on the right side of the market? pic.twitter.com/U4wiaahNLd

"Retail" investors (non-experts like you and me) are at an extreme disadvantage to "institutional" investors (large organizations, hedge funds, etc.) when it comes to success in the stock market. As a result, retail or individual investors are often late to the party. We're slow to react to certain changes in the market and by the time we finally catch up, the market changes.

Game of Trades shows this sentiment of the individual investor via the green line on the chart. Individual investors are adding to their "puts" or short positions (meaning they're expecting the market to go down) at record rates. But, if we look at past performance (on the chart - the sentiment of retail investors vs the SPX or S&P500 index) and how they are inversely correlated (near opposite), could we surmise that now could actually be a good time to buy instead of sell?

November 5, 2022

FED FOLLOWS MARKET RATES - NOT VICE VERSA!

— Henrik Zeberg (@HenrikZeberg) November 5, 2022

It is really that simple!

Hence, do not ask what #Powell will be doing. Observe structures in price/rates etc.

Rates are topping as Business Cycle tops. Then rolls over as Economy slows.

Everything else is pure chit chat! pic.twitter.com/jsn9KxTKJT

Henrik Zeberg is a technical analyst, meaning that he places a large emphasis on charts and chart indicators when developing an opinion about market conditions.

He argues here that the Federal Reserve considers the market or, in this case, the 2-year government bonds, when determining when to raise or lower the Federal Funds rate (interest rate).

Or at least it looks like that may make sense when going back to the early 1990s. We can see on the chart in the tweet that the Federal Funds rate was decreased when the 2-year government bonds price went down, increased when the price went up, and was mostly flat when price stabilized.

If this is true, then we would be able to predict when the interest rate increases will stop by watching this chart. Historical patterns aren't always proof of future performance, but it wouldn't hurt to monitor.

November 4, 2022

63% of Americans support the idea of new stimulus checks to combat inflation, according to a Newsweek poll.

— unusual_whales (@unusual_whales) November 4, 2022

Americans are overwhelmingly in support of fighting the pressures of inflation with by receiving stimulus checks from the U.S. government.

At face value, distributing money to lower inflation clearly doesn't add up. After all, we learned in school that more of something makes that something less valuable. That's why De Beers controls how many diamonds are released every year to make them appear rare (and expensive), and why the British army printed and distributed counterfeit Continental money during the American revolution to weaken the Continental army's purchasing power.

But I think it's worth taking a look at why the general public would think this would be a good idea. A few reasons that I can come up with:

- We'll always say yes to "free" money, or handouts. Why would you decline someone giving you money especially if you feel certain pressures (high gas prices, increased property taxes)? You may even feel like you deserve it.

- We're much more interested in what's in front of us now then what could happen later. "We'll give you $500 now, but things like milk will be double the price in a year." "No problem, I'll figure out the higher costs of things like milk later - when the time comes."

- The President of the United States is telling us that he's fighting inflation with these funds. We like to trust people, and we've always been told that the President is someone who we should respect, so he's probably worthy of our trust too, right?

Just a couple of interesting thoughts. We shouldn't just jump to the conclusion that "people are stupid" and point fingers. Assume the best of your fellow countrymen and women, and try to understand their concerns.

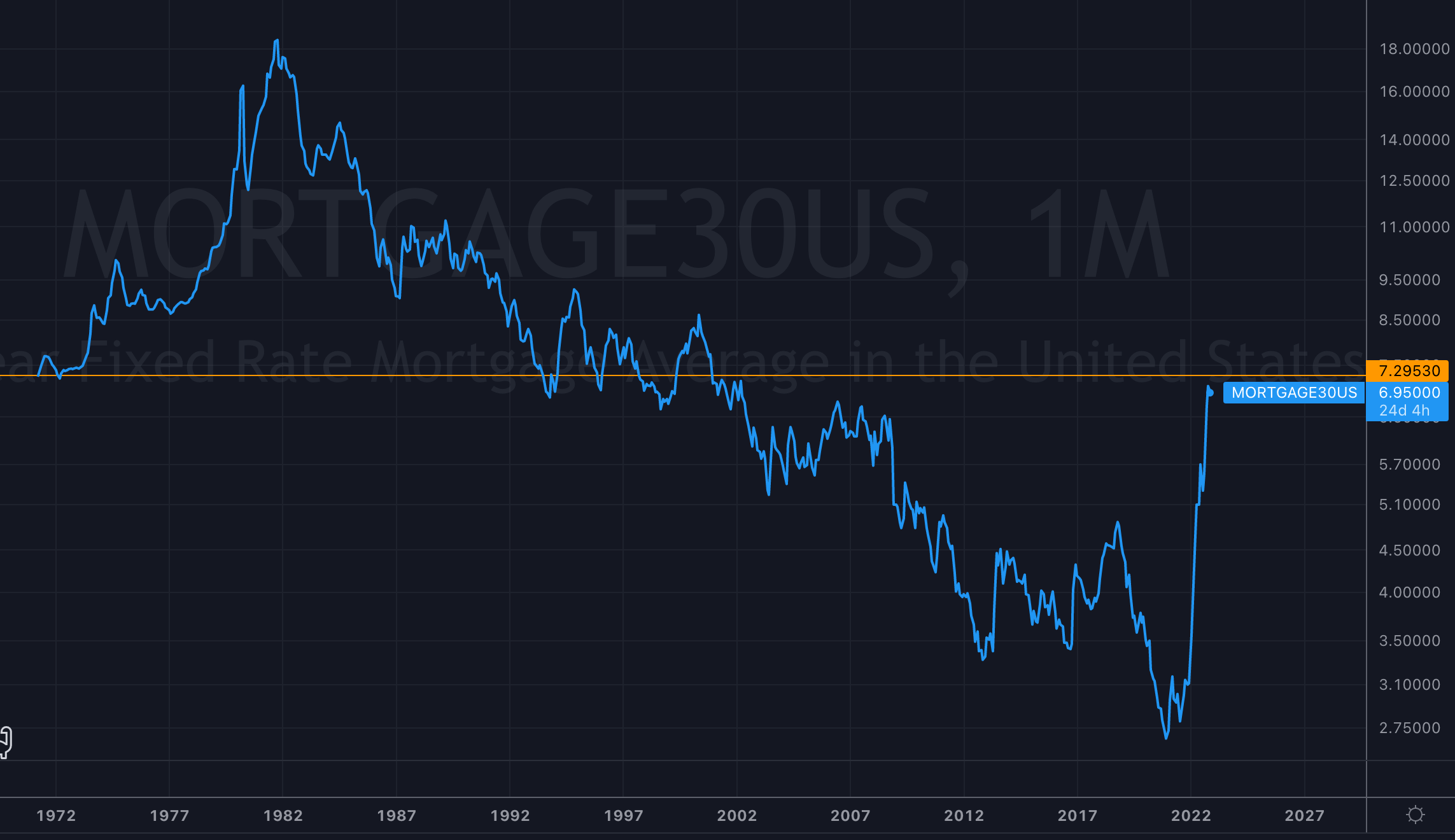

BREAKING: The average mortgage rates have hit 7.30%, the highest since 2000.

— unusual_whales (@unusual_whales) November 4, 2022

With the Federal Reserve announcing another 75-point rate increase in yesterday's meeting, residential, 30-year fixed mortgage rates reach 7.3% which is the highest since 2000. Here's the chart below showing the monthly rates since 1970.

Higher mortgage rates generally mean higher monthly payments relative to the principal owed on the loan, and lower home prices.

November 3, 2022

Job openings are concentrated in industries with heavy close-quarters customer interaction, and are often among the most overworked sectors.

— ???????????????? (@TXMCtrades) November 4, 2022

Is it any surprise that they're seeing record job openings in a post-pandemic economy while the likes of Apple and Amazon freeze hiring? pic.twitter.com/P6gdONyLJf

There are always certain jobs that individuals would prefer to do over others, so that's not up for debate. But I thought this data was interesting and worth reviewing. It shows the percentage change in job openings since January of 2021 - almost a full 2 years ago now.

Nearly all industries are trending up with the leaders being food service, entertainment, real estate, and healthcare as well since they haven't experienced a pullback yet.

Industries that are starting to really pull back in their hiring include finance/insurance and retail.

I'd be interested to see job opening data for computer services and IT, both because I work in that industry and news about massive layoffs in Twitter and a hiring pause at Apple were big talking points this week.

Starbucks stock rises in late trading as earnings, revenue top estimates https://t.co/n7E3rbuwtn

— MarketWatch (@MarketWatch) November 3, 2022

In a time of inflation putting extra pressure on consumers, they're still not willing to part with certain luxuries such as Starbucks coffee. Starbucks released their earnings report after the market today, and actually reported an increase in same-store sales by 7% worldwide.

Does this mean that they sold more coffee during the last quarter? That's possible, but probably what's more likely is that people are still buying coffee at the same rate as before even though Starbucks has raised their prices in the past few months (first reported in February).

Information like this can be helpful (along with data such as CPI and consumer confidence) to gauge how the average U.S. citizen is currently feeling about the economy - and, right now, there doesn't appear to be much fear in sight.

JUST IN: ???????? White House says the US is not in a recession.

— Watcher.Guru (@WatcherGuru) November 3, 2022

There's not much context in this actual tweet, but there's a lot behind the scenes such as the fact that we're less than a week away from mid-term elections and the democratic party wants the economy to appear strong so that voters will continue to vote them into office. (Note that we at Us Enduring do and will not pick a side when it comes to politics, but we'll call out any words or actions of politicians that are used in trying to cover up or hide the truth.)

Watcher Guru posted a more in-depth article providing some context to the tweet, where White House Chief of Staff Ron Klain said:

"We are not in a recession. Unemployment claims remain at a historical low. The economy is growing. It is strong. It is creating jobs."

But this contradicts with Jerome Powell, the Chair of the Federal Reserve, and what he said in September:

"No one knows whether this process will lead to a recession [raising rates], and if so, how significant that recession will be."

So, in this case, it's just important to keep in mind what the goal is of the White House at present time, and that's to appear strong and in control.

In this clip from yesterday's Fed meeting, Powell is asked why he is so insistent on continuing to tighten (raise rates) based on indicators that lag (Powell often cites the Consumer Price Index as his rational for raising rates, even though it requires more time for its changes to be realized).

Powell responded that they also closely monitor the Yield Curve spreads as well.

He was also asked about the severity of the rate raises compared to maybe scaling back a bit on raising rates and letting the market catch up.

Powell responded that they don't want to over tighten (raise rates by too much) but they will continue to tighten strongly until inflation goes down. And that:

"if we over tighten, then we have the ability with our tools ... to support economic activity strongly."

He also continued speaking on this and that if inflation isn't handled quickly enough, negative effects from it can linger for a couple of years and cause a greater negative impact on businesses and consumers.

There are mostly negative reactions to these statements by Powell - mostly that it will cause the stock market to "whipsaw" for decades, but would it be better to let inflation run rampant for a year or so instead? I'm not sure the answer to that.

November 2, 2022

In this economic cycle, how high will rates go ?

— Axel Merk (@AxelMerk) November 2, 2022

This is comical because there's only one answer provided in this poll - "No one knows" - but it's good to be aware that Jerome Powell and the Federal Reserve do not and have never had a flawless plan in place of raising and then stopping the raising of rates.

What Powell wants to see is a serious decrease in the inflation rate which, as of September, is 8.2% (we'll know October's rate on November 10th). Until then, he's going to keep raising rates.

Some project that the Federal Funds Rate could reach as high as 5% or even 5.25%, which is 1-1.25% higher than it is after yesterday's announcement. But if that doesn't work, expect rates to keep rising.

BREAKING: Apple, $AAPL, pauses hiring through 2023 amid recession fears, per BI.

— unusual_whales (@unusual_whales) November 2, 2022

BI refers this Business Insider and this article. But that article is gated, so here's another from 9To5Mac.

One thing to note are that they're not completely stopping hiring, just slowing it down. A quote from an Apple spokesperson said:

"We are continuing to hire but given the economic environment we're taking a very deliberate approach in some parts of the business ... we want to be thoughtful and make smart decisions that enable us to continue fueling innovation for the long term."

But that's what we want or expect from companies, right? To make thoughtful and smart decisions?

November 1, 2022

PMI came in at 45, housing is collapsing as is manufacturing data. The personal savings rate has collapsed, credit card debt is exploding. 37% of small businesses are behind on their rent.

— Sven Henrich (@NorthmanTrader) November 1, 2022

Don't tell me the consumer is strong & there is no recession in sight.

Sven is referring to the Purchasing Managers' Index that summarizes market conditions from the perspectives of purchasing managers. Any value below 50 is considered to be a sign of a shrinking economy. The index (since ~2012) has been below 50 only once and that was during the pandemic.

Housing is collapsing? Sven could be referring to the U.S. House Price Index which shows home prices declining as quarter 2, 2022. Or pending home sales which were down 10.2% in September (the 4th consecutive monthly decline) or existing home sales which were down 1.5% in September. And with the rising interest rates, the math says that sales and home prices will continue to decline in the months ahead.

Manufacturing is collapsing? This could be in reference to the PMI number.

I wrote a post the other day about the negative inversion between consumer credit card debt and personal savings. Basically, we're at national records for overall credit card debt (about $3,750 owed per U.S. adult on average) and lows for personal savings rate (only 3.5% of income is being saved on average).

37% of small businesses are behind on their rent? He's probably referring to this survey that was done by Alignable that showed 37% of small businesses weren't able to pay their rent in full during the month of October.

It sounds like he's addressing the Federal Reserve and Jerome Powell who is insistent on continuing to raise rates until the economy slows. In Sven's opinion, it's already slowed.

0 comments

Sign up or log in to join the conversation.