We, as a society, love subscriptions. For a consistent, simple rate, we can get access to certain services, products, food and even clothes on a regular basis.

And, since most subscriptions are on a monthly basis, they seem very affordable, too.

"$40 for the gym? No big deal."

"$20 for that streaming service? Sign me up."

"Only $60 to have full access to the gym? Of course!"

Businesses are coming up with more and more ways to sell their products as subscriptions, and consumers are having no problem with it! You can see the consistently rising trend of "subscription" search queries on Google since 2004:

Why are they so enticing? Several reasons:

- They lower the barrier to entry for consumers. Instead of paying $480 to access the gym, it's only $40 per month.

- They give us options. Who wouldn't want to have the option to choose from 5 different TV streaming services when choosing the next show to watch?

- Some companies don't offer anything else. "You want our food delivered to you?" or "Access to our quality content? You have to pay for a subscription."

- It's easier - more convenient. Would you rather spend the time looking for the right movie to watch, and then rent it? Or just subscribe for slightly more money and get access to everything?

But ...

Subscriptions are dangerous for consumers

Especially people who are trying to be forward-thinking and prepare for an economic depression.

Have you ever done this before? I signed up for a free trial of a streaming service. The full price was only $5 per month, but I didn't need or want to pay for the service. When the day came to cancel my trial before my card was charged, I was sorta half doing something else and didn't want to stop what I was doing and cancel at that time.

I figured, "meh, it's $5 ... I'll just cancel it before the end of next month." I completed disregarded $5. Like it was nothing!

And I know that wasn't the only time I've done that. In fact, I think I do that sort of thing quite regularly. I probably cost myself $50 per month on average by just having that sort of laissez faire attitude about a dollar.

I'm not blaming anyone else for that (it's clearly my fault), but I think the subscription culture (for the consumer) has something to do with that.

"I'll let it renew this month and cancel it next. But then that means that I'll still have access to the service for another month, so it's no big deal!"

The worst part is that I'll let this happen for a few months, and then have the nerve to pat myself on the back when I eventually do cancel the subscription because I'm being so responsible and eliminating ongoing expenses. The nerve of myself ...

Value your money again, even $1 of it

We need to learn to value our money again - even small amounts of it. Would you take action if it meant that you'd save yourself $1? Or would you be okay to let that dollar go if it meant you didn't have to do anything?

Would you even think twice before signing up for a $5 per month subscription? Or is that amount so small that you might as well?

I'm not judging you - I'm in the same boat. I need this "attitude adjustment" as much as anyone.

If you were asked how much money you spend on subscriptions per month, what would you say? (excluding necessities such as electricity, rent, even internet)

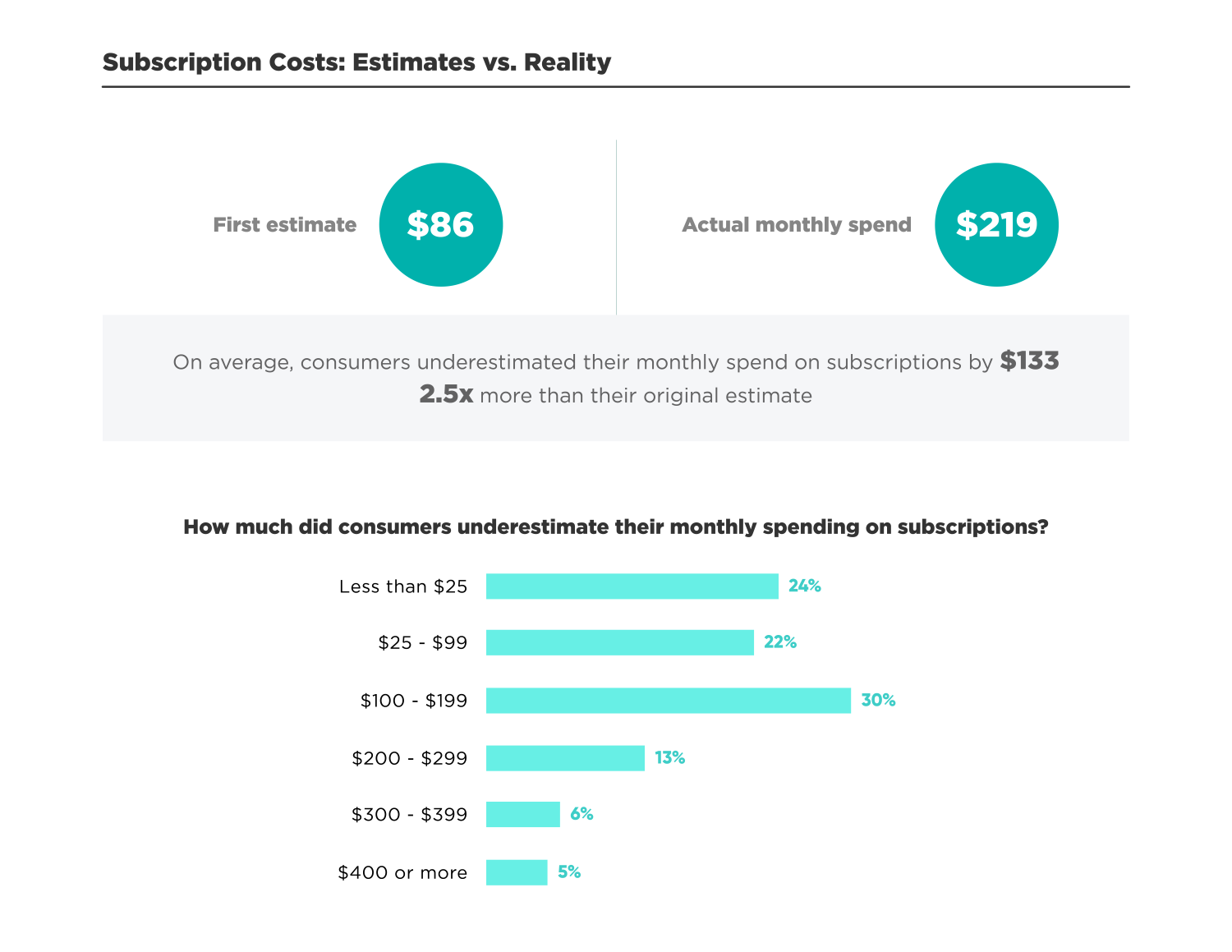

According to a study performed by C+R research, you're probably underestimating. The average answer to that question, just this past June, was $86. But the actual average spend was almost 3x that amount.

I think we need to perform self-audits of our expenses. Sit down and write out your ongoing subscriptions. Don't forget about the annual ones. You want to know exactly what's going out.

For me, I came up with:

- Netflix: $16/mo

- Hulu: $8/mo

- Disney+: $85/yr

- Guitar app: $140/yr

- Amazon Prime: $140/yr

- TruGreen lawn care: $75/mo

- Daughter's gymnastics: $90/mo

- Son's scouting: $75/yr

I know that's not all, but FYI, while doing this exercise, I just discovered that I was paying $10.99 per month for Showtime. What!? Cancel ...

If you haven't already, do it again but this time include all of your necessities as well. You should know exactly what's going out every month as well as you know what's coming in (your income).

Who knows, maybe just by writing this out you'll find that you're paying for unwanted services, too! At the very least, you'll be aware of where your money is going in subscriptions every month and every year.

What subscriptions can be replaced with a one-time expense?

The second part of this is to eliminate these subscriptions. The easiest way to do this is to just cancel them. But, what if you can't, or are unwilling to?

In that case, you'll need to figure out how to replace them. "Get off the grid" or free yourself from dependence on others, being a slave to their constant price increases.

If you were born in the 90s, you remember TV with commercials, and not having whatever show you wanted at your fingertips. Could you retrain yourself to be okay with that if it could play a role in your financial independence?

Maybe that's something that is near impossible for you to imagine yourself doing, and doing successfully.

In this article by Mic - "How to cure a Netflix addiction", Hilarie Cash, a licensed mental health counselor specializing in internet and screen addiction, says:

"A person who is a Netflix addict can either go cold turkey — and I am personally in favor of cold turkey because you would just take a break from screens for a very long time ... maybe forever," Cash said. "If you're not willing to do a cold turkey-approach, then it's called a hard reduction-approach, where you gradually wean yourself away. ... Set goals and install technology that will help you limit your screen time and reduce it until you are only watching as much as you have decided to watch. All of that is doable, but you have to be highly motivated to make that work."

But what about good things like a gym membership? You should definitely continue exercising, but how could you replace the membership fee?

This past year, I looked into a membership at my local gym. I reached out and found out that it would be $60 per month plus a $99 join fee. Any classes or access to special areas such as the tennis courts would be extra.

Honestly, what probably set me off was the $99 join fee. "So, you're punishing me for joining your gym?"

So, I ran some numbers ... $60 per month per year would be $720 per year ($820 for year 1 with the joining fee ...). With inflation being crazy, wouldn't be surprised to see that go up to $80 per month next year, and then maybe $100 and so on.

After 3 years, I'd be approximately $2,980 out of pocket just for the right to go to the gym every month. Yikes - no wonder we like subscriptions! $60 doesn't sound bad, but $3,000!?

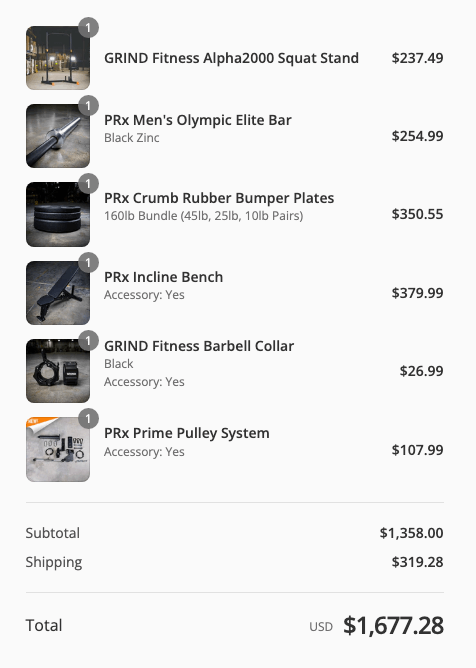

What I decided to do was buy some equipment for my home instead. I bought a treadmill for $1,200 and a squat rack with a bench, bar and weights for about $1,700. Funny that it came out to about the same $3,000 mark.

The weights and rack should be good for many years. The treadmill could break down after a few, but hopefully, I'll get a few years out of it. After about 3 years, if I did the math on inflation correctly, I'll be saving money and not have to worry about being victim to whatever the gym decides to do.

I understand that this might not be realistic for everyone. You may not have the space for a home gym. You may not have the money up front.

The point is to replace and/or remove the money that you're committing to going out every month, and paid subscriptions are a big part of that.

Get in better control of your finances as we all prepare for a coming economic downturn. And share what you've done to save below!

2 comments

Sign up or log in to join the conversation.