The other day, I asked the community to share how they were preparing for the economic depression.

One of the things that has been on my mind as a real possibility for me, is that I could quite possibly lose my job. And then I was thinking that it might not be a bad idea to actually expect it.

Think about it, one of the things that causes the most anxiety to adults in the United States, both during bad economic times and good, is the fear of losing their jobs.

So, if we expect difficult times for the country and our world in the near future, job loss for many of us is a real possibility.

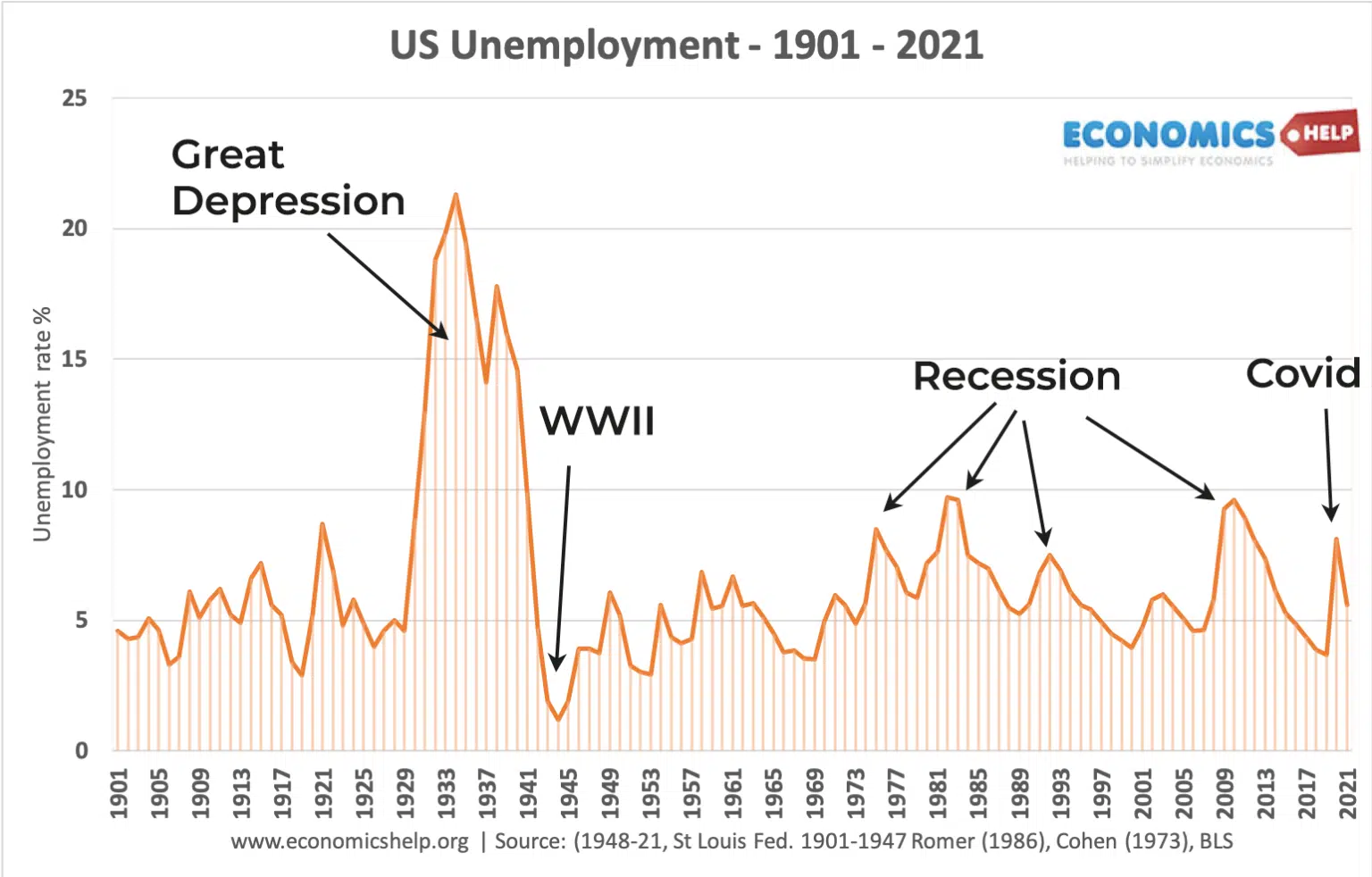

Right now, the unemployment rate in America is 3.5%. During the recession starting in 2008, the unemployment rate peaked at 9.9% in 2009 (1 in 10 Americans was without a job).

During the Great Depression of the 1920s and 30s, unemployment reached a high of 24.9% in 1933. That would be 1 in 4 Americans without a job.

If the rates remain similar, the odds are fair (~75%) that you would still have a job. But what if we prepared with the expectation that we wouldn't?

As I've given this more thought, that's how I've decided to proceed. Mentally, it helps me not to "fear the worst" as I'm already planning for it. Financially, hopefully I'll be more suited to weather the storm.

So, what can we do with that expectation in place - the expectation that at some point in the near future we will lose our jobs?

Prepare mentally

If this is true, at some point you will get called into a meeting with your manager who will inform you that they're going to have to let you go. Maybe they'll say things like "times are tough" or "we had to make this difficult decision" or even "you've made positive contributions and we wish that we could keep you".

It's not going to be an easy conversation for anyone - but especially you as you now have to move forward without the security of your typical paycheck.

But you can prepare by walking through this scenario in your mind. Visualize yourself getting the email, sitting down with your boss and the feeling of hopelessness that you'll be tempted to feel.

It's not fun, but if you prepare then you'll remember in this dark moment that you have a plan and it will be okay.

Prepare financially

If you're expecting to lose your job, then you're also expecting at least a temporary pause in your income. Would you be able to survive without a paycheck for a few weeks or months - at least until you're able to secure new employment?

You need to build and grow your emergency fund - the money that you're setting aside in case of emergency such as losing your source of income.

If you don't currently have one, then you need to start living below your means now. Remove unnecessary luxuries from your lifestyle. Save $50, $100, $500 or more per month and transfer it directly to your savings account.

A good rule of thumb is to have 3-4 months of your income saved in an emergency fund. So, if, with your job, you make $4,000 per month, you'll need to build an emergency fund of $12,000 to $16,000.

Make a list of expenses that you can cut - now, or if the worst happens such as job loss.

I have a family of 6, so we have quite a few additional expenses that we could cut out of our monthly budget, if necessary. Such as ...

- My daughter's gymnastics ~$100 per month

- My son's soccer ~ $40 per month

- All of my kids swimming lessons ~ $150 per month

- Hulu, Netflix ~ $30 per month

- Regular, weekend family excursions ~ $500 per month

- Cable ~ $50 per month (but we'd still need the internet package)

- Food, could be simplified ~ $100 per month

There are other items, but that's approximately $1,000 per month that we could remove from our budget. If we're truly expecting to lose our jobs, maybe we should be proactive and cut some of these expenses now. But, at the very least, I'll have a go-to list of subscriptions to end at a moment's notice.

Prepare skillfully

If you lose your job, you're likely going to want to attain new employment elsewhere as quickly as possible. To help with that, you should make sure that you're prepared as a qualified job candidate.

Are there any skills that you should learn and acquire, or licenses or certifications that would make you stand out as a better candidate?

You can take this to the next level by developing yourself with skills in areas that are more important (or even necessary) during economic downturns. Industries that tend to be less affected to poor economies include:

- Health care

- Government

- Computers and information technology

- Education

- Government

Companies within these industries may likely do their own version of cost-cutting, but if you're needing to get a new job it might as well be in an industry less affected, as opposed to the industries that are usually hit the hardest, such as:

- Restaurants

- Travel and tourism

- Real estate

- Entertainment

- General manufacturing

Prepare by securing part-time employment now

Just like you can start cutting back on your expenses now, you might also want to consider getting a part-time job now instead of waiting until you absolutely need it.

A part-time job might not be the final solution to your unemployment troubles, but it could help you buy more time until you can secure full-time employment.

For example, let's say that your monthly expenses are $4,000 per month. If you have only $8,000 in an emergency fund, then you have only 2 months to secure a new position. Or even less than that because you'll need to receive your first paycheck within that 2-month window to avoid being late on any expenses.

But, let's say that you have a part-time job that brings in $2,000 per month. With that, you'd only need to use $2,000 of your emergency fund per month to cover your $4,000 in expenses. You've just doubled your safety window from being able to survive 2 months without full-time employment to 4 months.

Sure, you could wait to attain a part-time position until you've lost your job, but that could take time which would mean you'd have to start dipping into your emergency fund right away, and you'd miss out on having the extra confidence now by knowing you have a bit of a cushion.

Write out your plan of response

One of the reasons why losing a job is so stressful is because you have to figure out how to move forward while really feeling down about yourself.

That's why you should put together a plan of action that you can follow - emotions aside.

What do you do after walking out of that meeting with your manager? What about a week later? Who do you call?

Your plan might look something like this:

- File for unemployment by going to https://___.com/unemployment. Need to do this within 3 days after being laid off.

- Pause current, luxury subscriptions (see above)

- Call person's name and person's name and let them know I'm looking for new employment.

- Update profile on LinkedIn and apply to 3 jobs.

- Apply to 10 jobs per day on LinkedIn and Indeed (full or part time to at least get some income).

If I knew I had a plan of action, I think that I would feel so much more prepared and able to get through and survive the trial of losing my job.

What else do you think might be helpful if you or someone else lost their job? Please benefit the community by sharing your thoughts in the comments below!

1 comments

Sign up or log in to join the conversation.